US v SR [2014] EWHC 175 (Fam)

Related

PM v RM [2025] EWFC 11

https://caselaw.nationalarchives.gov.uk/ewfc/2025/11

Mr Justin Warshaw KC sitting as a Deputy High Court Judge. Application for maintenance pending suit, a legal services payment order and an injunction in a high value financial remedy case.

Facts

W (45) and H (68) began cohabiting in 2015, moved

WX v HX [2023] EWFC 279 (B)

https://caselaw.nationalarchives.gov.uk/ewfc/b/2023/279

Mr Recorder Day’s judgment in a case involving complex procedural history, intervenors, non-disclosure and a ‘fragile’ business valuation. Of note is Recorder Day’s inclusion of his earlier decision to refuse a Hadkinson order. Recorder Day determined that debarring a

The Duty of Disclosure: as Important Now as Ever

The duty of disclosure and its proactive nature runs through financial remedy proceedings like letters through a stick of seaside rock. It appears on the face of the Form E. It has been set out in numerous cases. As was noted in Bokor-Ingram v Bokor-Ingram [2009] 2 FLR 922 by

Read the journal

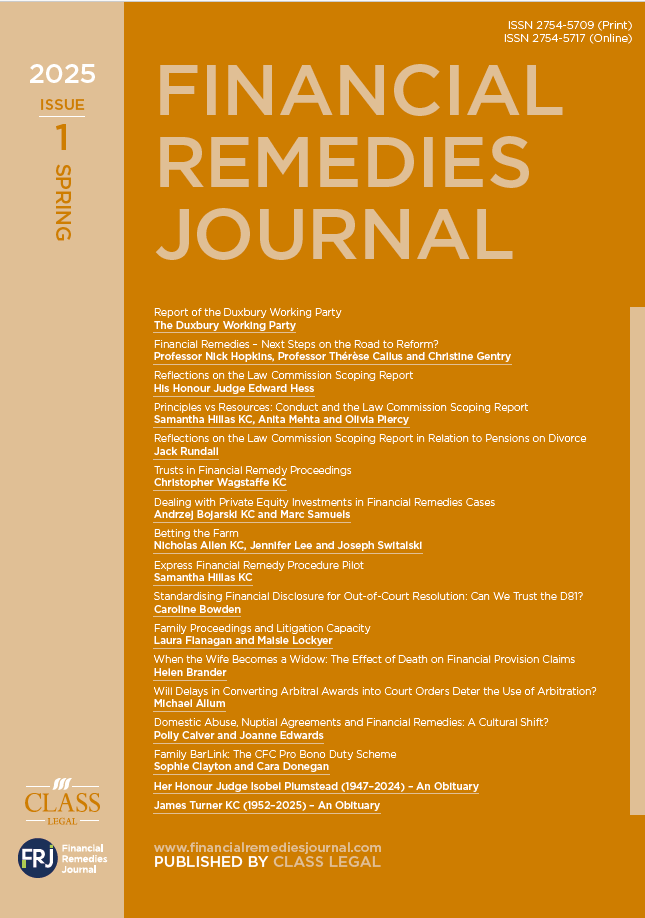

Financial Remedies Journal – 2025 Issue 1 | Spring

Related

PM v RM [2025] EWFC 11

https://caselaw.nationalarchives.gov.uk/ewfc/2025/11

Mr Justin Warshaw KC sitting as a Deputy High Court Judge. Application for maintenance pending suit, a legal services payment order and an injunction in a high value financial remedy case.

Facts

W (45) and H (68) began cohabiting in 2015, moved

WX v HX [2023] EWFC 279 (B)

https://caselaw.nationalarchives.gov.uk/ewfc/b/2023/279

Mr Recorder Day’s judgment in a case involving complex procedural history, intervenors, non-disclosure and a ‘fragile’ business valuation. Of note is Recorder Day’s inclusion of his earlier decision to refuse a Hadkinson order. Recorder Day determined that debarring a

The Duty of Disclosure: as Important Now as Ever

The duty of disclosure and its proactive nature runs through financial remedy proceedings like letters through a stick of seaside rock. It appears on the face of the Form E. It has been set out in numerous cases. As was noted in Bokor-Ingram v Bokor-Ingram [2009] 2 FLR 922 by

Latest

Of Dogs and Divorce

Of dogs and divorce: why treating pets as chattels is an anachronism.

This is Ernest, our beloved English bull terrier. According to English law he has the same status as the chaise longue upon which he is performing his Kate Winslet impersonation. How can this be right? How can he

Pre-Nuptial Agreements: an ‘Oven-Ready’ Solution to a Pressing Problem? A House of Lords Debate

Late last month, Baroness Deech brought a motion in the House of Lords, ‘That this House takes note of the law relating to prenuptial agreements’.

The debate came against the backdrop of Baroness Deech having (of course) long pursued financial remedies reform through her Divorce (Financial Provision) Bill. She has

Stamp Duty Land Tax and Divorce

This is sometimes the forgotten tax on divorce. Maybe this is fair enough as there is a pretty clear exemption in tax law that states that stamp duty land tax (SDLT) will not apply to transfers pursuant to divorce.

However, the last few years have seen the introduction of two