Norris v Norris [2002] EWHC 2996 (Fam)

Related

Vince v Vince [2024] EWFC 389

https://caselaw.nationalarchives.gov.uk/ewfc/2024/389

Cusworth J. A long marriage with substantial wealth, held mostly in H’s green energy business. Questions of how to treat political donations; attributing value to pre- and post-marital business efforts; and discounting the value of a business already sold.

Ultimately, W

AF v GF [2024] EWHC 3478 (Fam)

https://caselaw.nationalarchives.gov.uk/ewhc/fam/2024/3478

Mr Geoffrey Kingscote KC (sitting as a Deputy High Court Judge). Useful analysis of business matrimonialisation and quantification of assets, including the valuation of pre-marital business interests. The judgment clearly covers the two-stage exercise in Charman v Charman [2007] EWCA Civ

HKW v CRH [2024] EWFC 358 (B)

https://caselaw.nationalarchives.gov.uk/ewfc/b/2024/358

DDJ Rose. Final hearing in modest asset case. Court making findings on the validity of H’s purported loans/gifts to the parties’ children. Consideration of the Kimber factors concerning point of cohabitation.

Facts

The parties married in 2007. The date

Read the journal

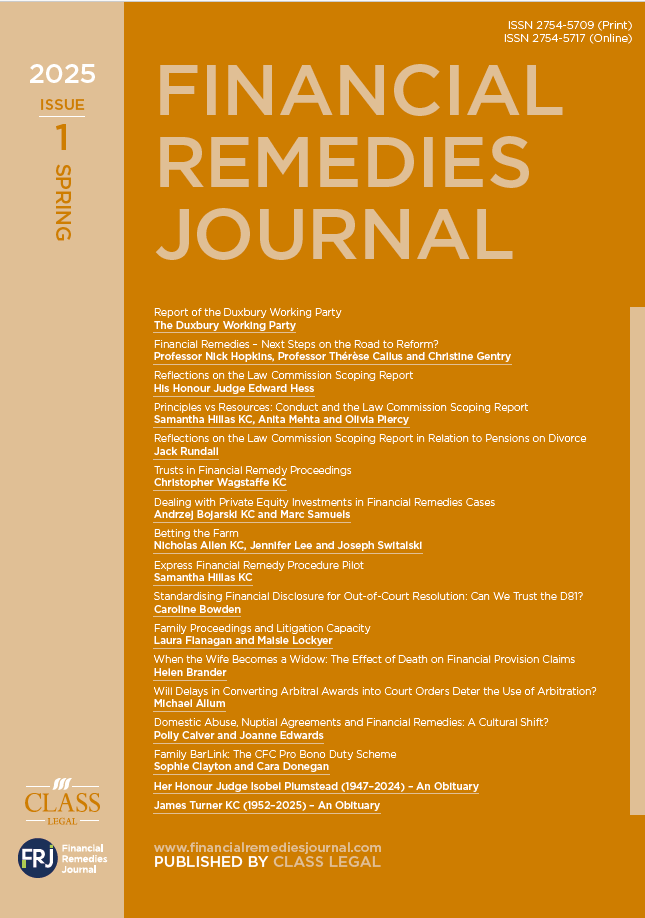

Financial Remedies Journal – 2025 Issue 1 | Spring

Related

Vince v Vince [2024] EWFC 389

https://caselaw.nationalarchives.gov.uk/ewfc/2024/389

Cusworth J. A long marriage with substantial wealth, held mostly in H’s green energy business. Questions of how to treat political donations; attributing value to pre- and post-marital business efforts; and discounting the value of a business already sold.

Ultimately, W

AF v GF [2024] EWHC 3478 (Fam)

https://caselaw.nationalarchives.gov.uk/ewhc/fam/2024/3478

Mr Geoffrey Kingscote KC (sitting as a Deputy High Court Judge). Useful analysis of business matrimonialisation and quantification of assets, including the valuation of pre-marital business interests. The judgment clearly covers the two-stage exercise in Charman v Charman [2007] EWCA Civ

HKW v CRH [2024] EWFC 358 (B)

https://caselaw.nationalarchives.gov.uk/ewfc/b/2024/358

DDJ Rose. Final hearing in modest asset case. Court making findings on the validity of H’s purported loans/gifts to the parties’ children. Consideration of the Kimber factors concerning point of cohabitation.

Facts

The parties married in 2007. The date

Latest

Of Dogs and Divorce

Of dogs and divorce: why treating pets as chattels is an anachronism.

This is Ernest, our beloved English bull terrier. According to English law he has the same status as the chaise longue upon which he is performing his Kate Winslet impersonation. How can this be right? How can he

Pre-Nuptial Agreements: an ‘Oven-Ready’ Solution to a Pressing Problem? A House of Lords Debate

Late last month, Baroness Deech brought a motion in the House of Lords, ‘That this House takes note of the law relating to prenuptial agreements’.

The debate came against the backdrop of Baroness Deech having (of course) long pursued financial remedies reform through her Divorce (Financial Provision) Bill. She has

Stamp Duty Land Tax and Divorce

This is sometimes the forgotten tax on divorce. Maybe this is fair enough as there is a pretty clear exemption in tax law that states that stamp duty land tax (SDLT) will not apply to transfers pursuant to divorce.

However, the last few years have seen the introduction of two