Haines v Hill & Anor [2007] EWCA Civ 1284

Related

Money Corner: New Tax Landscape for High Net Worth Divorces

The dust has (almost) settled following the Autumn Budget and April 2025 will bring about one of the biggest overhauls of the way the UK taxes foreign individuals in decades.

This piece covers the changes to the non-domicile (non-dom) regime and the other smaller measures announced in the budget that

DDR v BDR (Financial Remedies, Beneficial Ownership and Insolvency) [2024] EWFC 278

https://caselaw.nationalarchives.gov.uk/ewfc/2024/278

Alexander Chandler KC sitting as a High Court Judge. A complicated case, involving a consideration of three areas of law: insolvency, trusts of land, and financial remedies. Useful analysis of how the courts address the tension between paying creditors under a bankruptcy

Stamp Duty Land Tax and Divorce

This is sometimes the forgotten tax on divorce. Maybe this is fair enough as there is a pretty clear exemption in tax law that states that stamp duty land tax (SDLT) will not apply to transfers pursuant to divorce.

However, the last few years have seen the introduction of two

Read the journal

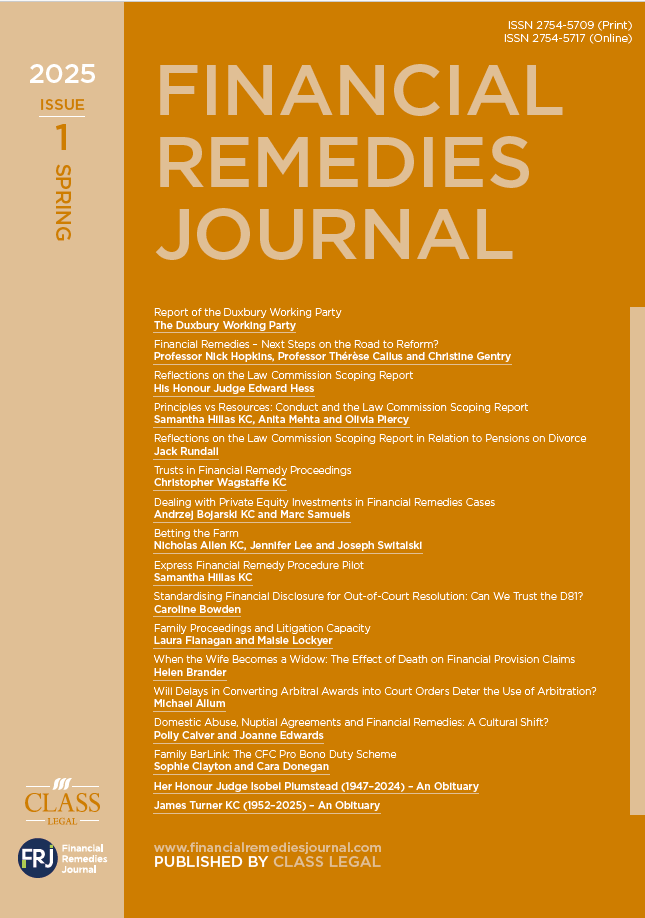

Financial Remedies Journal – 2025 Issue 1 | Spring

Related

Money Corner: New Tax Landscape for High Net Worth Divorces

The dust has (almost) settled following the Autumn Budget and April 2025 will bring about one of the biggest overhauls of the way the UK taxes foreign individuals in decades.

This piece covers the changes to the non-domicile (non-dom) regime and the other smaller measures announced in the budget that

DDR v BDR (Financial Remedies, Beneficial Ownership and Insolvency) [2024] EWFC 278

https://caselaw.nationalarchives.gov.uk/ewfc/2024/278

Alexander Chandler KC sitting as a High Court Judge. A complicated case, involving a consideration of three areas of law: insolvency, trusts of land, and financial remedies. Useful analysis of how the courts address the tension between paying creditors under a bankruptcy

Stamp Duty Land Tax and Divorce

This is sometimes the forgotten tax on divorce. Maybe this is fair enough as there is a pretty clear exemption in tax law that states that stamp duty land tax (SDLT) will not apply to transfers pursuant to divorce.

However, the last few years have seen the introduction of two

Latest

Of Dogs and Divorce

Of dogs and divorce: why treating pets as chattels is an anachronism.

This is Ernest, our beloved English bull terrier. According to English law he has the same status as the chaise longue upon which he is performing his Kate Winslet impersonation. How can this be right? How can he

Pre-Nuptial Agreements: an ‘Oven-Ready’ Solution to a Pressing Problem? A House of Lords Debate

Late last month, Baroness Deech brought a motion in the House of Lords, ‘That this House takes note of the law relating to prenuptial agreements’.

The debate came against the backdrop of Baroness Deech having (of course) long pursued financial remedies reform through her Divorce (Financial Provision) Bill. She has

Stamp Duty Land Tax and Divorce

This is sometimes the forgotten tax on divorce. Maybe this is fair enough as there is a pretty clear exemption in tax law that states that stamp duty land tax (SDLT) will not apply to transfers pursuant to divorce.

However, the last few years have seen the introduction of two