Begum v Ahmed [2019] EWCA Civ 1794

Related

Dignam-Thomas and Bebbington v McCourt and Another (Inheritance Act 1975) [2023] EWHC 546 (Fam)

https://caselaw.nationalarchives.gov.uk/ewhc/fam/2023/546

Theis J. Application by two sisters in parlous financial and physical health for reasonable financial provision from their father’s estate, the estate having been left to their brother. Application was limited by 1975 Act to what was reasonable in all

Kaur v Singh and Others [2023] EWHC 304 (Fam)

https://www.bailii.org/ew/cases/EWHC/Fam/2023/304.html

Peel J. Claim under the Inheritance Act 1975 for reasonable financial provision from her deceased husband under Part 8 of the CPR. The claim was undefended. The claimant sought half of the estate which she estimated at £995,000.

Paul v Paul & Ors [2022] EWHC 1638 (Fam)

https://www.bailii.org/ew/cases/EWHC/Fam/2022/1638.html

Moor J.

Application by K for reasonable financial provision from estate of her late husband S, and a declaration that the FMH in S’s sole name was held on constructive trust for herself and S’s estate in

Read the journal

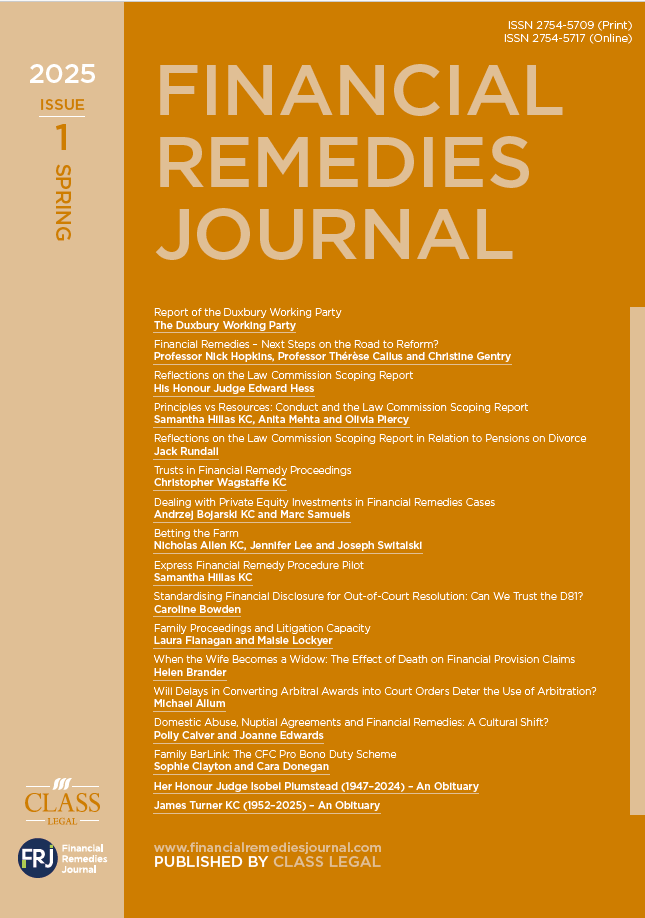

Financial Remedies Journal – 2025 Issue 1 | Spring

Related

Dignam-Thomas and Bebbington v McCourt and Another (Inheritance Act 1975) [2023] EWHC 546 (Fam)

https://caselaw.nationalarchives.gov.uk/ewhc/fam/2023/546

Theis J. Application by two sisters in parlous financial and physical health for reasonable financial provision from their father’s estate, the estate having been left to their brother. Application was limited by 1975 Act to what was reasonable in all

Kaur v Singh and Others [2023] EWHC 304 (Fam)

https://www.bailii.org/ew/cases/EWHC/Fam/2023/304.html

Peel J. Claim under the Inheritance Act 1975 for reasonable financial provision from her deceased husband under Part 8 of the CPR. The claim was undefended. The claimant sought half of the estate which she estimated at £995,000.

Paul v Paul & Ors [2022] EWHC 1638 (Fam)

https://www.bailii.org/ew/cases/EWHC/Fam/2022/1638.html

Moor J.

Application by K for reasonable financial provision from estate of her late husband S, and a declaration that the FMH in S’s sole name was held on constructive trust for herself and S’s estate in

Latest

Of Dogs and Divorce

Of dogs and divorce: why treating pets as chattels is an anachronism.

This is Ernest, our beloved English bull terrier. According to English law he has the same status as the chaise longue upon which he is performing his Kate Winslet impersonation. How can this be right? How can he

Pre-Nuptial Agreements: an ‘Oven-Ready’ Solution to a Pressing Problem? A House of Lords Debate

Late last month, Baroness Deech brought a motion in the House of Lords, ‘That this House takes note of the law relating to prenuptial agreements’.

The debate came against the backdrop of Baroness Deech having (of course) long pursued financial remedies reform through her Divorce (Financial Provision) Bill. She has

Stamp Duty Land Tax and Divorce

This is sometimes the forgotten tax on divorce. Maybe this is fair enough as there is a pretty clear exemption in tax law that states that stamp duty land tax (SDLT) will not apply to transfers pursuant to divorce.

However, the last few years have seen the introduction of two